If you’ve experienced a dog attack and need legal advice, please contact our California dog bite attorneys to review your rights. There are a lot of factors that go into a dog bite case, and it can be very complicated. Our experienced team can help you understand and protect your rights. Call (800) 561-4887 for a free consultation.

As the evidence and statistics mount pertaining to dangerous dogs and dog attacks, insurance carriers are coming down on dog owners.

The two most widely used strategies by the insurance industry are preventing the sale of policies to owners of particular dog breeds and/or excluding dog bites and other dog-related injuries from insurance coverage.

Some insurance companies include comprehensive lists of dogs that will void coverage or even policy sales, such as this one from AAA:

Pit Bulls & Rottweilers (No full-bred or mix) Akita – including Japanese and Akita Inu Bernese – including Mountain Dog, Berner Sennenhund and Bernese Cattle Dog Canary Dogs – including Perro de Presa Canario, Chow Chow, Doberman, Husky – including American, Eskimo, and Greenland (Siberian is OK), Karelian Bear Dog, Rhodesian Ridgeback Russo, European Laika – including Russian Laika and Karelian Bear Laika. Any breed of guard dog trained to attack. Wolf Hybrids. The foregoing applies to both purebred and mixed-breed dogs.

A study by the University of Florida found that dog bites have increased drastically over the years. From 2005-2020 there was a 68% increase in dog bites reported in children under ten years old.

Insurance Banned Dog Breed

Should Insurance Companies Be Able to Decline Coverage For People Who Own Certain Dog Breeds?

The idea of insurance companies declining coverage for people who own certain dog breeds is a tricky ethical question. On the one hand, there are insurance companies that believe that they should be able to decline coverage for people who own certain dog breeds if they have a history of aggressive behavior.

On the other hand, some people believe that this is discriminatory and should not be allowed.

This is an issue because some insurance companies feel that it would be unfair to offer coverage to a person who owns a breed of dog that has been known to cause harm or damage at some point in time.

The other side of this argument is that denying someone coverage because they have one type of dog could lead to discrimination against different social groups.

What other factors should insurance companies consider when evaluating a dog owner’s risk?

The insurance company should take into account the size of the dog, the age of the dog, and if there is any history of aggression.

Insurance companies consider more factors when evaluating a dog owner’s risk. The dog’s size is an important factor because it can indicate how much damage a dog might do if it attacks someone. It also depends on the breed and its tendency for aggression.

Insurance companies have been banning certain dog breeds from their policies because they are more likely to bite and be aggressive. These breeds include pit bulls, German shepherds, rottweilers, and Dobermans.

Why Some Insurance Companies Have Breed Restrictions

There are a few reasons why some insurance companies have breed restrictions but the most common are for dogs that are considered to be “dangerous breeds.” These breeds include:

- Pit Bulls

- Rottweilers

- German Shepherds

- Doberman Pinschers

- Chows

- Great Danes

- Akitas

- Alaskan Malamutes

- Siberian Huskies

- Wolf Hybrids

If your dog is on the restricted breed list, you may still be able to get insurance coverage however, you will likely have to pay higher premiums. You may also have to agree to certain conditions, such as having your dog spayed or neutered, or agreeing to keep your dog on a leash at all times.

Your insurance may also have the right to drop your coverage if you have a banned breed and lied about it. A lot of people will try to pass a banned breed off as a non-banned breed. Proponents of dogs say that is discrimination, but those opposed will argue about the dangers these dogs pose to the public.

Increase in Dog Bite Insurance Payouts

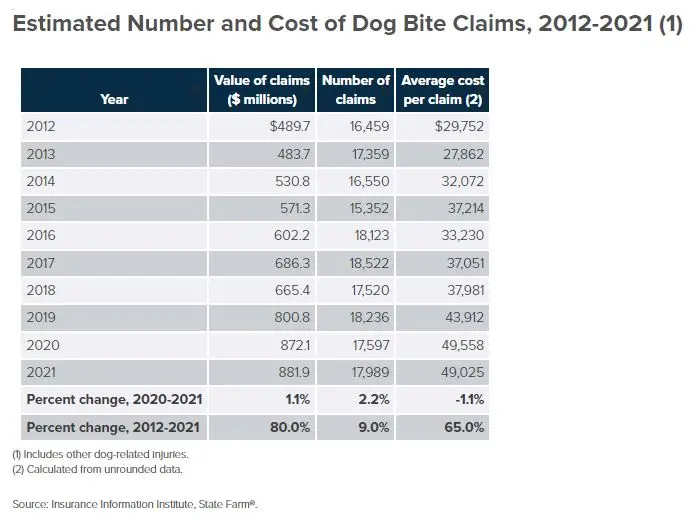

A dog bite now costs much more than it did in the past, according to an analysis by the Insurance Information Institute (iii.org). Dog bites and other canine-related injuries accounted for $882 million in homeowners insurance liability claim payments in the year 2021, which accounts for more than one-third of total U.S. homeowner claim payouts. The average dog bite claim was $49,000.00

While claims have dropped 2 percent over the last 10 years, the cost per claim has soared. This is due to increased medical costs as well as the size of settlements, judgments, and jury awards given to plaintiffs. California had the highest rate of dog bite claims filed.

As of April 2024, these are the latest stats released by the III.

Understanding Dog Insurance Requirements and Coverage

Regardless of whether you are a homeowner or a renter, insurance is required and you are required to disclose your pet ownership.

Some insurance agencies will charge higher premiums to those who own certain breeds of dogs, but mostly they will either refuse to sell you a policy or exclude your dog and any injuries it causes from your policy coverage.

This means that in the event that your dog does bite or attack someone, you will be liable. The recent changes throughout the insurance industry have put a great deal of stress on homeowners and renters who own dogs that are deemed to be dangerous breeds.

- Dog owners who do not have insurance for dog bites can lose their homes, their assets, and their income as a result of a single dog bite incident unless they are insured for it. Although a number of dog bites do not result in serious injury, the sad fact is that a significant number do cause devastating scars and disfigurement.

- Dog bite victims certainly deserve to receive payment for their serious losses, but if dog owners are not insured and do not have assets or income, then there is no way that the victim can truly receive monetary support.

- Society always pays the price of uncompensated, uninsured losses because the community ends up paying the medical bills, the state pays disability and unemployment benefits, and welfare pays the rest. This might result in the government taking action that might not be in the best interest of dog owners, namely banning certain breeds of dogs, or making it illegal to not have dog bite insurance.

Dog Owner Liability Insurance

As a result of the insurance industry putting breed bans in place, several new insurance agencies have formed. These new insurance agencies are in the business of offering Dog Owner Liability Insurance (sometimes referred to as canine liability coverage).

What It Covers:

- The cost of injuries to third parties caused by a dog bite or attack.

- Bites and attacks that occur on the insurance owner’s property.

- Some policies cover property damage incurred by the dog.

- Policies usually come with a maximum benefit dollar amount. (The insurance carrier will only pay up to a certain dollar amount every year.)

What It Does Not Cover:

- Legal actions, suits, or procedures. The dog owner is still liable to the legal system. You can still be fined or jailed by the county or state and the insurance carrier does not cover these charges.

Factors That Determine Eligibility

- Whether or not your dog has a history of biting, attacking, or aggressive behavior.

- Whether or not your dog holds any certificates in obedience training.

- Whether or not your male dog is neutered, as this tends to curb aggression.

- Whether or not your property is fenced and secure.

- Whether or not the dog is leashed or confined when outside, reducing the ability for the dog to come into contact with others.

In the event that your dog has been deemed vicious or dangerous, your Dog Liability Insurance can be suspended or canceled completely.

State Dog Breed Bans

In 29 states there are dog breed bans according to the Insurance Institute. Keeping up with the latest bans on specific types of canines by state can be difficult.

The implementation of breed bans is becoming increasingly prevalent in the US, with lots of states introducing regulations on particular breeds. It is important for people to be aware of their state’s pet ownership laws and how those may affect the ability to keep a certain kind of dog.

Every area has its own rules concerning pet ownership and whether or not they have any type of ban on certain breeds; some regions adopt a “one-size-fits-all” policy while others look more at individual cases when reaching decisions about canine bans.

Data collected by government agencies or other organizations can also be utilized to decide if one specific breed should be prohibited from being owned within an area, whereas sometimes jurisdictions will use their own discretion when determining which breeds should not be permitted inside their borders.

These choices are typically based upon public opinion rather than scientific evidence and this could lead to questionable prohibitions being put into place with no consideration given to responsible owners who might find themselves unable to keep their beloved four-legged friends due to legal restrictions outside their control.

The efficacy of dog breed bans has been debated for many years, with some in favor and others against. Proponents of such laws argue that banning certain breeds can help decrease the amount of dog-related injuries or fatalities.

When a Dog Bite Becomes a Million-Dollar Liability - As of 2025

Video: A new law in Las Vegas may offer hope to some pet owners facing breed bans by insurance companies.

When Dogs Bite

Since California is a no-fault state, you will be able to seek compensation for a dog bite that resulted in moderate or serious injuries. Dog bite cases can include a lot of mental and physical injuries.

Recovering emotionally from the trauma of a dog bite can be a long, hard road. Be sure you explore all of your opportunities under the law including any medical care you receive. Use safety precautions when you encounter dogs you are not familiar with.

Brian Chase

Articles, blogs, and content have been reviewed by legal in-house staff. Brian Chase is the managing partner of Bisnar Chase Personal Injury Attorneys, LLP. He is the lead trial lawyer and oversees cases handling dangerous and defective products that injure consumers. Brian is a top-rated injury attorney with numerous legal honors and awards for his work relating to auto defects and dangerous products. His firm has recovered over $1B for its clients. Brian is a frequent speaker for CAOC, Dordick Trial College, and OCTLA, covering personal injury trial techniques.